Payment History and How It Affects Your Credit Score

Build strong credit

while you save

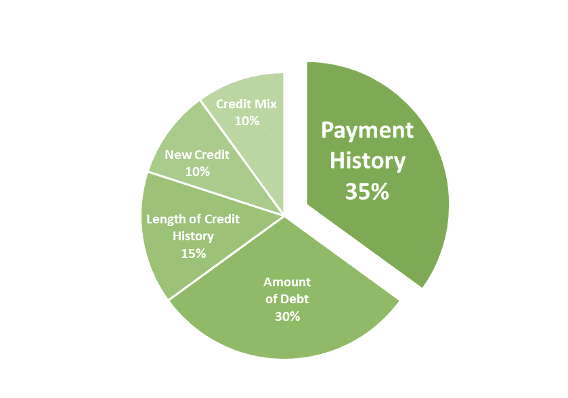

Payment history is the most important factor in calculating your FICO® credit score.

Your payment history accounts for over a third of your overall FICO credit score, comprising 35% of the impact of all FICO credit score factors. The chart below shows what factors impact your FICO credit score and how much each factor impacts your score. Read more about the factors that impact your credit score.

What is payment history?

Payment history is the record of all your past payments and whether they were paid on-time or late. Payment history can also include missing payments if no payment was ever made. Your payment history typically includes payments for all your credit cards, installment loans (e.g. vehicle loans and personal loans), retail accounts (e.g. store credit cards or purchases made using store financing or credit), and home mortgage loans.

Since payment history is so critical to having a great credit score, it is important to understand how your Payment history is defined and calculated.

How is payment history calculated?

How is a payment defined as on-time or late for the purpose of calculating your credit score?

Payments are reported to the three major consumer credit bureaus (Equifax, Experian, and TransUnion) as ‘on-time’ if they are made on or before the date they are due.

Many people wonder what happens if you missed credit card payment or missed credit card payment by one day. Does a one day late payment affect credit score? Fortunately, most lenders also provide a 29-day grace period after the payment due date before reporting a payment as late to the credit bureaus. If you make your payment during this grace period, your payment will be reported as on-time, exactly the same as if you had made it on or before the due date.

The examples below illustrate two different payment patterns and how each would be reported on your credit report and used to calculate your credit score.

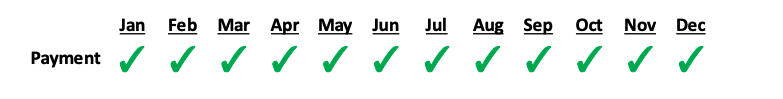

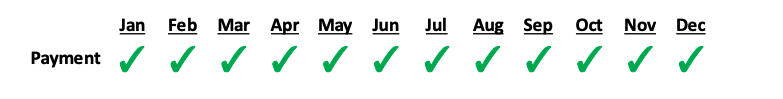

Example 1:

All payments made on-time: payments made on or before the due date.

Example 2:

Payments made on-time, except April payment made 17 days late and August payment made 29 days late (after the payment due dates).

Key:

✓ Payment reported as ‘On-time’

X Payment reported as ‘Late’

Note that while a payment made after its due date may still be reported as ‘on-time’ to the credit bureaus, a lender may charge you a late-payment fee for payments made after the due date or after a late fee grace period (e.g. 15 days after the payment was due) and a lender may increase your interest rate or decrease the amount of credit available to you.

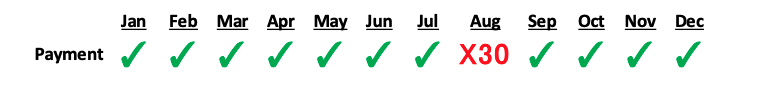

Now let’s make one small change to Example 2. Rather than making your August payment 29 days late, the payment is made just one day later, so it was 30 days late. The payment history reported to the credit bureaus would now look like the following:

Example 3:

Payments made on-time, except April payment made 17 days late and August payment made 30 days late (after the payment due dates).

Your credit report will now show a 30-day late payment and this late payment will negatively impact your credit score. As you can see, delaying your payment by just one additional day significantly changes your payment history that is reported to the credit bureaus.

What is the impact of late payment on credit score?

Lenders will often report each payment to one or more of the three largest consumer credit bureaus (Equifax, Experian, and TransUnion). Lenders typically report when a payment was received: on-time, 30, 60, 90 days late, or never received.

Many people wonder: how does a late payment affect your credit? According to FICO’s credit damage data, one single recent late payment can cause your credit score to drop by as much as 180 points. This is because a late payment is a red flag to lenders that you may be experiencing trouble repaying your debts, making you riskier to lend to and a greater credit risk which increases the lender’s risk of losing money by lending to you.

While a 180 point drop is a drastic change, you might only experience a credit score decrease that severe if you had excellent credit before the late payment and made the late payment very late (for example 90 days late). For most people a 30-day late payment would decrease their score from about 20 to 80 points.

As you can see, a 700 credit score with late payments would be negatively impacted much more than a lower score with late payments. That said, if your goal is to get a 700 credit score, you need to avoid any late payments.

So the answer to: How does a late payment affect your credit score? Is really ‘it depends’ based on how late the payment was, what your score was before the late payment, and how recently the late payment was made.

An unblemished or perfect payment history tells lenders that you are a reliable and low-risk borrower which increases your odds of receiving a new loan or credit card with lower interest rates. If you have a history of missed or late payments, you are considered a higher risk by lenders. However, it may still be possible to be approved for a loan or credit card with a bad payment history, though it often comes with a higher interest rate and lower amounts of credit being approved.

Using payment history to build credit

Many people want to build credit fast. While there are many programs and ‘experts’ that market how to build credit fast, the reality is that the best way to build credit is to establish a responsible pattern of on-time repayment over many months and years. The longer and larger your on-time payment history, the better. In fact, as you saw in the chart at the beginning of this article, Length of Credit History accounts for 15% of your FICO credit score. To improve your payment history, you must make on-time payments on all of your credit accounts. That’s it!

So, how can you establish a great payment history to build credit? For people who already have good credit or great credit the answer is simple, continue to make your payments on-time.

For people with no credit, poor credit, or thin credit, there are also several options.

How to improve payment history on your credit report

For individuals with no credit history, bad credit, or limited credit history, here are three great options to build payment history and build credit:

- Secured credit card

- Credit builder loan / Credit builder account

- Experian Boost

Secured Credit Card

Secured credit cards are credit cards that require you to make a cash deposit before using them. Secured credit cards are available to just about anyone because they eliminate the lender’s risk. When you sign up for a secured credit card, you deposit cash with the lender equal to your credit line. You can then use the credit card to make payments just like a normal (unsecured) credit card.

For example, after making a deposit of $500 with a lender, you will receive a credit card with a credit limit of $500. You can use your secured credit card just like you would with any other credit card. If you don’t repay the lender, they simply deduct the amount you owe from the cash deposit you made.

Secured credit cards build your revolving account credit history for your credit mix.

Credit Builder Loan / Credit Builder Account

Many people don’t have the money to deposit $500 with a lender to obtain a secured credit card or don’t want to make a large cash deposit to get a credit card. Fortunately, there is a great option available for building payment history and credit without an up-front deposit requirement.

Credit Strong credit builder loans / credit builder accounts allow almost anyone to add a positive payment history to their credit report. All you have to do is pick a plan and make your payments on-time. With plans starting with monthly payments of less than $20 per month Credit Strong credit builder loans are affordable for just about anyone.

Credit Strong credit builder loans are reported to the credit bureaus as an installment account on your credit report. Having an installment account included in your credit report is important to your credit mix and building a strong credit profile.

In addition, a credit builder loan allows you to build installment credit history and do not require an up-front deposit to get started. A side benefit is that as you are building your payment history, you are also setting aside savings, so you are building your credit and savings at the same time. A win-win!

It gets better, a Credit Strong account does not require a credit check to open, sometimes called a hard credit pull. You can open a Credit Strong credit builder loan account in less than 3 minutes 100% online on your phone or computer from almost anywhere.

Our credit builder loans have been rated as one of the best credit builder loans on the market. (We think it’s the best, but we’re biased.)

Credit Strong is a division of Austin Capital Bank, a 5-star rated independent community bank that is FDIC insured, so you know it’s legit.

Experian Boost

Many people think that utility payments (e.g. phone, gas, water, electric bills) are included in their credit report and credit score. Unfortunately, utility payments have historically not been used in consumer credit reports unless you defaulted on your account and it was sent to collections. Said another way, utility bills were only counted against you, never for you.

Recently Experian came out with a new product called Experian Boost. It allows customers to report non-debt payments like utilities and cell phone bills to the credit bureau.

Customers’ testimonials seem to indicate that Experian Boost can help your credit if you are just getting started building or rebuilding your credit.

One thing to note, if you plan to try Experian Boost, you have to grant Experian access to your bank account history so it can monitor your payments, so there is a tradeoff between the privacy of your financial information and building your credit.

How long does a late payment affect your credit?

To recover from bad payment history, you must make consistent on-time payments. After two years, your credit score should recover from the effect of the missed payments. Two years can feel like a long time for credit score recovery after late payment so it’s much better to try to avoid making ANY payments more than 30 days past due if at all possible.

Final thoughts on payment history and your credit score

Building a great credit score can take time, but almost anyone can improve their credit score with determination and good payment habits.

If your credit score is currently suffering due to a poor payment history, take control of your score and credit life by starting a new pattern of on-time payment today.

One of the best tools available for building payment history is Credit Strong since you can build a solid and long payment history for your credit profile with an installment account that reports your payments monthly to the three major credit bureaus and build your savings at the same time.

Now go out there and transform your life with strong credit!

FICO is a registered trademark of Fair Isaac Corporation. Credit Strong is a registered trademark of Austin Capital Bank. Experian is a registered trademark of Experian and its affiliates.

CreditStrong helps improve your credit and can positively impact the factors that determine 90% of your FICO score.